The Babysitter portion of the class will run from 9:00am - 3:00pm, followed by the Pet Sitter portion from 3:00 - 4:00pm. Please note, students are only able to register for the Pet Sitter Add-On if they complete the Babysitter portion of the class on the same day. PARENTS MUST CHECK IN THEIR STUDENT TO CLASS IN PERSON. Babysitter: Learn to be safe and responsible. Build confidence. Have a competitive edge over other babysitters. Topics include first aid, when and how to call 911, CPR with manikin practice, choking, dealing with difficult behaviors, basic care methods like feeding and diapering, marketing and more! Students will also learn how to be safe and responsible when home alone, including the importance of not giving out personal information and what to do if somebody comes to the door. Students who successfully complete the course requirements will receive a certificate of completion for Certified Babysitter/CPR/First Aid course by Live Safe Academy (valid for two years). Please note that students must arrive on time to be certified, so please arrive up to 10 minutes early. To be certified students must participate in the entire course from beginning to end and successfully complete all skills, which requires full motor function of all four extremities. Parents, this class is for students who are independent and responsible enough to be responsible for the safety and well-being of younger children without adult supervision. Class will end between 2 PM and 3 PM depending on when students complete the course requirements. Students need a lunch, snacks, and a fully charged cell phone (if they own one). If your student does not have a cell phone, please write down the cell phone number of the person picking them up and give it to the student. Students will message their ride at lunchtime to let their ride know what time to pick them up. Pen and paper for notes is optional. No cell phone use during class except during break. No refunds or credit with less than 24-hour notice. If you need a medical exception, email Live Safe Academy at info@LiveSafeAcademy.com before class. Please check in your student at the beginning of class. Drop off and pick up is in the same room as class. For more information please visit: https://www.livesafeacademy.com/babysitting/ Pet Sitter: Kids, would you like to learn pet first aid and be a certified Pet Sitter? Increase your competitive edge by being more valuable to families with pets and kids. Increase your market by being certified to watch pets or kids. Learn to care for the pets in your own family. Have fun and help keep animals safe. Topics include pet first aid, CPR, choking, and more! This is an add on class for students who successfully complete the Certified Babysitter/CPR/First Aid course on the same day (students of a previous Live Safe Academy Certified Babysitter/CPR/First Aid course can become a certified pet sitter by taking our live virtual class). Pet Sitter/CPR/First Aid certificates are only issued to students who pass the LSA Babysitter/CPR/First Aid program. This program will begin after the babysitter safety class ends. Class should be concluded by 3 PM to 4 PM, depending on when the babysitter safety course is completed. No refunds or credit with less than 24-hour notice. If you need a medical exception, email Live Safe Academy at info@LiveSafeAcademy.com before class. For more information please visit: www.livesafeacademy.com/babysitting/

Certified Babysitter/CPR/First Aid and Safe Home Alone (And Pet Sitter Add-On)Safety & Youth SkillsThe Babysitter portion of the class will run from 9:00am - 3:00pm, followed by the Pet Sitter portion from 3:00 - 4:00pm. Please note, students are only able to register for the Pet Sitter Add-On if they complete the Babysitter portion of the class on the same day. PARENTS MUST CHECK IN THEIR STUDENT TO CLASS IN PERSON. Babysitter: Learn to be safe and responsible. Build confidence. Have a competitive edge over other babysitters. Topics include first aid, when and how to call 911, CPR with manikin practice, choking, dealing with difficult behaviors, basic care methods like feeding and diapering, marketing and more! Students will also learn how to be safe and responsible when home alone, including the importance of not giving out personal information and what to do if somebody comes to the door. Students who successfully complete the course requirements will receive a certificate of completion for Certified Babysitter/CPR/First Aid course by Live Safe Academy (valid for two years). Please note that students must arrive on time to be certified, so please arrive up to 10 minutes early. To be certified students must participate in the entire course from beginning to end and successfully complete all skills, which requires full motor function of all four extremities. Parents, this class is for students who are independent and responsible enough to be responsible for the safety and well-being of younger children without adult supervision. Class will end between 2 PM and 3 PM depending on when students complete the course requirements. Students need a lunch, snacks, and a fully charged cell phone (if they own one). If your student does not have a cell phone, please write down the cell phone number of the person picking them up and give it to the student. Students will message their ride at lunchtime to let their ride know what time to pick them up. Pen and paper for notes is optional. No cell phone use during class except during break. No refunds or credit with less than 24-hour notice. If you need a medical exception, email Live Safe Academy at info@LiveSafeAcademy.com before class. Please check in your student at the beginning of class. Drop off and pick up is in the same room as class. For more information please visit: https://www.livesafeacademy.com/babysitting/ Pet Sitter: Kids, would you like to learn pet first aid and be a certified Pet Sitter? Increase your competitive edge by being more valuable to families with pets and kids. Increase your market by being certified to watch pets or kids. Learn to care for the pets in your own family. Have fun and help keep animals safe. Topics include pet first aid, CPR, choking, and more! This is an add on class for students who successfully complete the Certified Babysitter/CPR/First Aid course on the same day (students of a previous Live Safe Academy Certified Babysitter/CPR/First Aid course can become a certified pet sitter by taking our live virtual class). Pet Sitter/CPR/First Aid certificates are only issued to students who pass the LSA Babysitter/CPR/First Aid program. This program will begin after the babysitter safety class ends. Class should be concluded by 3 PM to 4 PM, depending on when the babysitter safety course is completed. No refunds or credit with less than 24-hour notice. If you need a medical exception, email Live Safe Academy at info@LiveSafeAcademy.com before class. For more information please visit: www.livesafeacademy.com/babysitting/2026

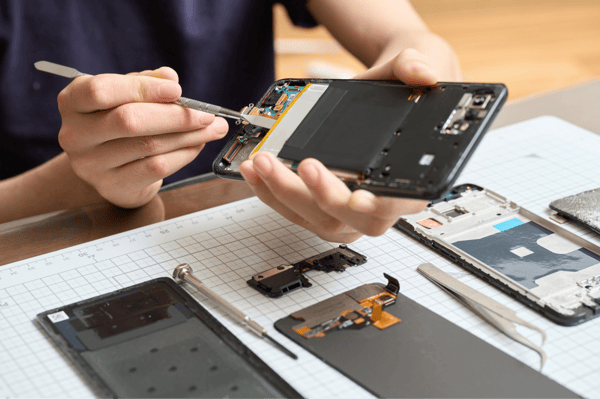

Certified Babysitter/CPR/First Aid and Safe Home Alone (And Pet Sitter Add-On)Safety & Youth SkillsThe Babysitter portion of the class will run from 9:00am - 3:00pm, followed by the Pet Sitter portion from 3:00 - 4:00pm. Please note, students are only able to register for the Pet Sitter Add-On if they complete the Babysitter portion of the class on the same day. PARENTS MUST CHECK IN THEIR STUDENT TO CLASS IN PERSON. Babysitter: Learn to be safe and responsible. Build confidence. Have a competitive edge over other babysitters. Topics include first aid, when and how to call 911, CPR with manikin practice, choking, dealing with difficult behaviors, basic care methods like feeding and diapering, marketing and more! Students will also learn how to be safe and responsible when home alone, including the importance of not giving out personal information and what to do if somebody comes to the door. Students who successfully complete the course requirements will receive a certificate of completion for Certified Babysitter/CPR/First Aid course by Live Safe Academy (valid for two years). Please note that students must arrive on time to be certified, so please arrive up to 10 minutes early. To be certified students must participate in the entire course from beginning to end and successfully complete all skills, which requires full motor function of all four extremities. Parents, this class is for students who are independent and responsible enough to be responsible for the safety and well-being of younger children without adult supervision. Class will end between 2 PM and 3 PM depending on when students complete the course requirements. Students need a lunch, snacks, and a fully charged cell phone (if they own one). If your student does not have a cell phone, please write down the cell phone number of the person picking them up and give it to the student. Students will message their ride at lunchtime to let their ride know what time to pick them up. Pen and paper for notes is optional. No cell phone use during class except during break. No refunds or credit with less than 24-hour notice. If you need a medical exception, email Live Safe Academy at info@LiveSafeAcademy.com before class. Please check in your student at the beginning of class. Drop off and pick up is in the same room as class. For more information please visit: https://www.livesafeacademy.com/babysitting/ Pet Sitter: Kids, would you like to learn pet first aid and be a certified Pet Sitter? Increase your competitive edge by being more valuable to families with pets and kids. Increase your market by being certified to watch pets or kids. Learn to care for the pets in your own family. Have fun and help keep animals safe. Topics include pet first aid, CPR, choking, and more! This is an add on class for students who successfully complete the Certified Babysitter/CPR/First Aid course on the same day (students of a previous Live Safe Academy Certified Babysitter/CPR/First Aid course can become a certified pet sitter by taking our live virtual class). Pet Sitter/CPR/First Aid certificates are only issued to students who pass the LSA Babysitter/CPR/First Aid program. This program will begin after the babysitter safety class ends. Class should be concluded by 3 PM to 4 PM, depending on when the babysitter safety course is completed. No refunds or credit with less than 24-hour notice. If you need a medical exception, email Live Safe Academy at info@LiveSafeAcademy.com before class. For more information please visit: www.livesafeacademy.com/babysitting/2026 Starting SoonFix-It Together: Free Community Tech WorkshopSafety & Youth SkillsBring your gadgets, your curiosity, and your willingness to learn. Our Free Tech Repair Workshop is part guided repair session, part open tinkering lab, and fully community-powered. Whether you have an older phone with a cracked screen, a laptop with battery issues, or just want to learn how devices work, this is the place to do it. Guided by fellow Grosse Pointe community member and high school student at Grosse Pointe North High School, Gavin Perry has experience in electronics repair, both through GPPSS Tech Department fixing Chromebook's, and personally. He currently fixes phones/laptops not only for himself, but for his friends as well! Here’s how it works: Guided Repairs – Work alongside experienced repairers as we walk through common fixes like phone screen swaps, battery replacements, and basic laptop repairs. Hands-On Practice – No device? No problem. Practice on our provided devices and tools. Open Tinkering Time—Try repairs on your own gear, explore new techniques, or collaborate with others. This isn’t a formal class—it’s a collaborative community workshop where we learn by doing, share skills, and help each other out. The session will run 3 hours, and all skill levels are welcome! Cost: Free. Bring: Your device (if you have one) and a willingness to get hands-on.2026

Starting SoonFix-It Together: Free Community Tech WorkshopSafety & Youth SkillsBring your gadgets, your curiosity, and your willingness to learn. Our Free Tech Repair Workshop is part guided repair session, part open tinkering lab, and fully community-powered. Whether you have an older phone with a cracked screen, a laptop with battery issues, or just want to learn how devices work, this is the place to do it. Guided by fellow Grosse Pointe community member and high school student at Grosse Pointe North High School, Gavin Perry has experience in electronics repair, both through GPPSS Tech Department fixing Chromebook's, and personally. He currently fixes phones/laptops not only for himself, but for his friends as well! Here’s how it works: Guided Repairs – Work alongside experienced repairers as we walk through common fixes like phone screen swaps, battery replacements, and basic laptop repairs. Hands-On Practice – No device? No problem. Practice on our provided devices and tools. Open Tinkering Time—Try repairs on your own gear, explore new techniques, or collaborate with others. This isn’t a formal class—it’s a collaborative community workshop where we learn by doing, share skills, and help each other out. The session will run 3 hours, and all skill levels are welcome! Cost: Free. Bring: Your device (if you have one) and a willingness to get hands-on.2026